Much More Than Just a Brokerage!

Kingston Finance is a partner to companies seeking financial support to develop and grow their business. Our service essentially falls into two categories—commercial mortgages and business funding—but we go way beyond just operating as finance brokers. We take a targeted approach in understanding your business and focusing on how to get you the right financial support you need. We provide insights, best practices, and critical assistance in getting you the right finance, with the most competitive products, from reputable lenders.

Take Our Free Financial Review

Gain clarity and confidence with a complimentary financial review from Kingston Finance. Whether you’re looking for commercial mortgages, business funding, or personal finance options, our experts assess your goals and connect you with the most competitive solutions.

What Can We Help You With?

Explore Our Services: Commercial Mortgages, Business Funding, Home Mortgages, and Insurance

Commercial Mortgages

We can support a wide variety of commercial funding types including property development funding, buy-to-let and more. Whether you’re a developer or SME, we act as your dedicated commercial financing broker to secure bespoke lending.

Business Funding

Support your business with cashflow options, business loans, invoice finance and motor & equipment leasing. We operate as a skilled business loans broker, matching you with over 100 lenders to maximise your opportunities.

Home Mortgages

Whether you are just stepping onto the property ladder or remortgaging a property portfolio, we’re happy to help!

Insurances

We offer a variety of insurance solutions, including income protection, critical illness cover and more. As your insurance broker, we customise protection that works in line with your financial goals.

Frequently Asked Questions

1. What does a finance broker do?

A finance broker acts as an intermediary between clients and financial institutions, helping clients find suitable financial products like loans, mortgages, or insurance. They provide expert advice and negotiate terms on behalf of their clients.

2. How can a mortgage broker help me?

A mortgage broker assists in finding the best mortgage deals by comparing various lenders. They guide you through the application process, ensuring you understand the terms and conditions, and help secure favourable interest rates.

3. What services do business loan brokers offer?

Business loan brokers help businesses secure funding by connecting them with suitable lenders. They assess financial needs, recommend loan options, and assist with the application process to ensure businesses get the best possible terms.

Contact Us for Tailored Financial Solutions

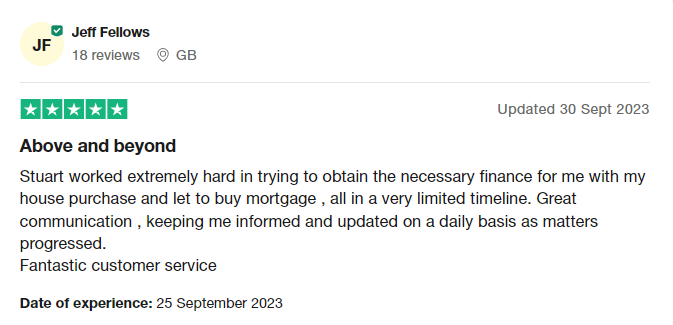

Led by Kingston Finance Founder Stuart Johnston, we treat each client on their own merits with a very unique set of circumstances. Stuart established Kingston Finance, having spent years in the finance industry, witnessing good businesses with great ideas fail due to a lack of understanding and support from the bigger financial institutions. Very often, this is simply due to the rigid and formulaic way in which banks review finance applications. It can be a daunting and complex scenario getting it just right, and finance brokers like Kingston Finance can help you to make sense of it.